tax shield formula dcf

This companys tax savings is equivalent to the interest payment. Is the levered DCF formula to calculate FCF the following one.

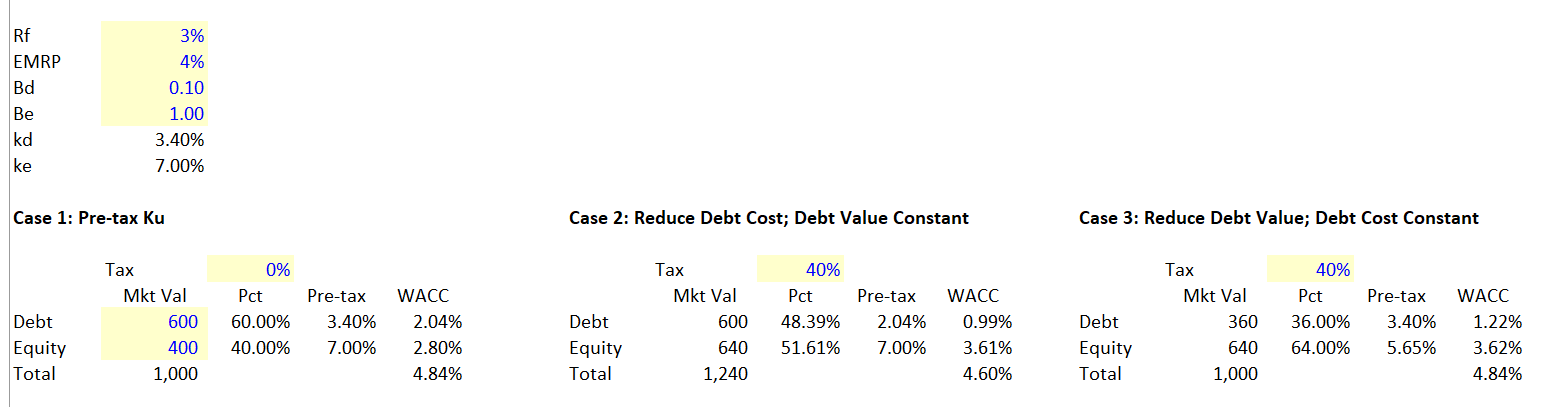

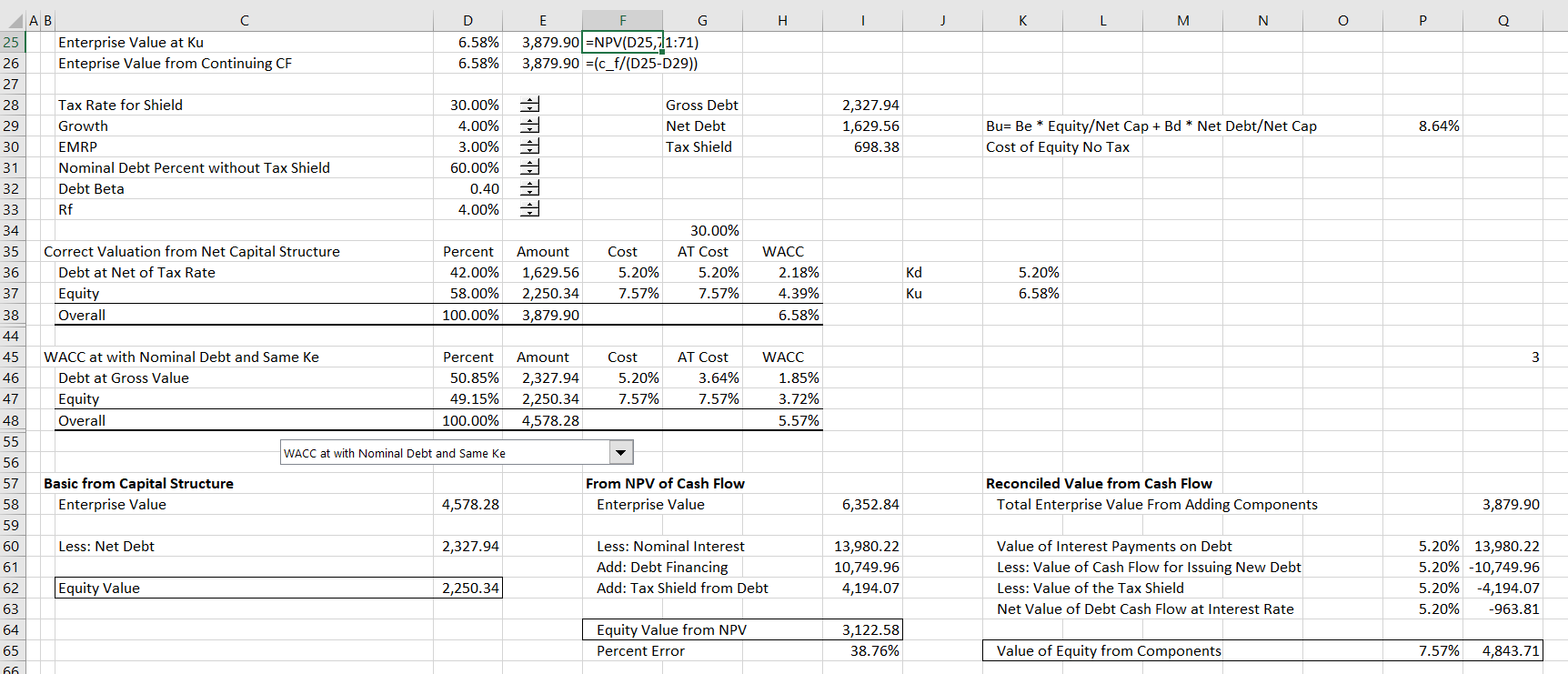

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

And stand for debt and equity of the firm and are the required return rates for debt and equity is the marginal tax.

. Taxes 8 million 20 16 million. The effects of the tax shield should be used in all cash flow analyses since the amount of cash paid in taxes is impacted. Why is Unlevered Free Cash Flow Used.

However here in FCF formula we dont account the Tax shield because we are going to discount the FCF by the WACC that already factors in the impact of tax shield and. A tax shield is the deliberate use of taxable expenses to offset taxable income. Editorial content from The Ascent is separate from The Motley Fool.

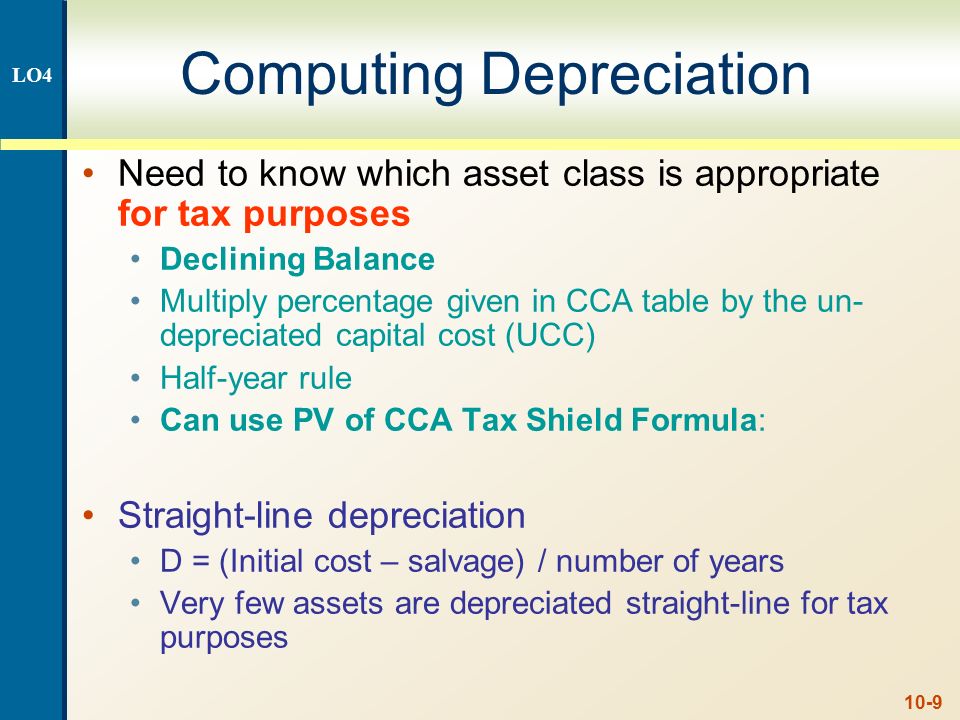

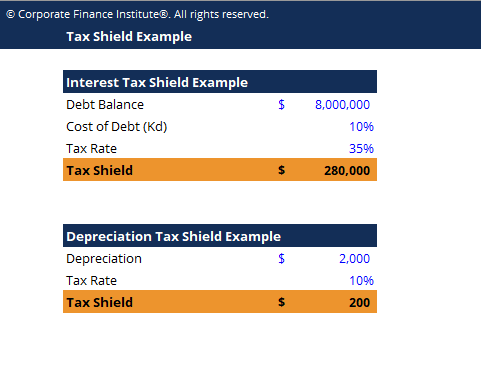

Interest Tax Shield Example. Levered DCF Formula. Interview questions around the Depreciation Tax Shield are quite common because it ties directly into the Discounted Cash Flow DCF analysis process.

A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. Net Income 8 million 16 million 64 million. The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below.

Calculate WACC Weighted Average Cost of Capital Terminal value DCF. Now in the second step we have to calculate the cost incurred on working capital. The formula includes that comes from tax shield savings.

The adjusted present value is the net present value NPV of a project or company if financed solely by equity plus the present value PV of any. In Scenario B the taxes recorded for book purposes is 400k lower than under Scenario A. Formula and Excel Calculator.

Re cost of. FCF EBIT 1-T DA - CAPEX - Change in working capital -. Interest Tax Shield.

Interest Tax Shield Interest Expense Deduction x. Adjusted Present Value - APV. Unlevered free cash flow is used to remove the impact of capital structure on a firms value and to make companies more.

The formula is.

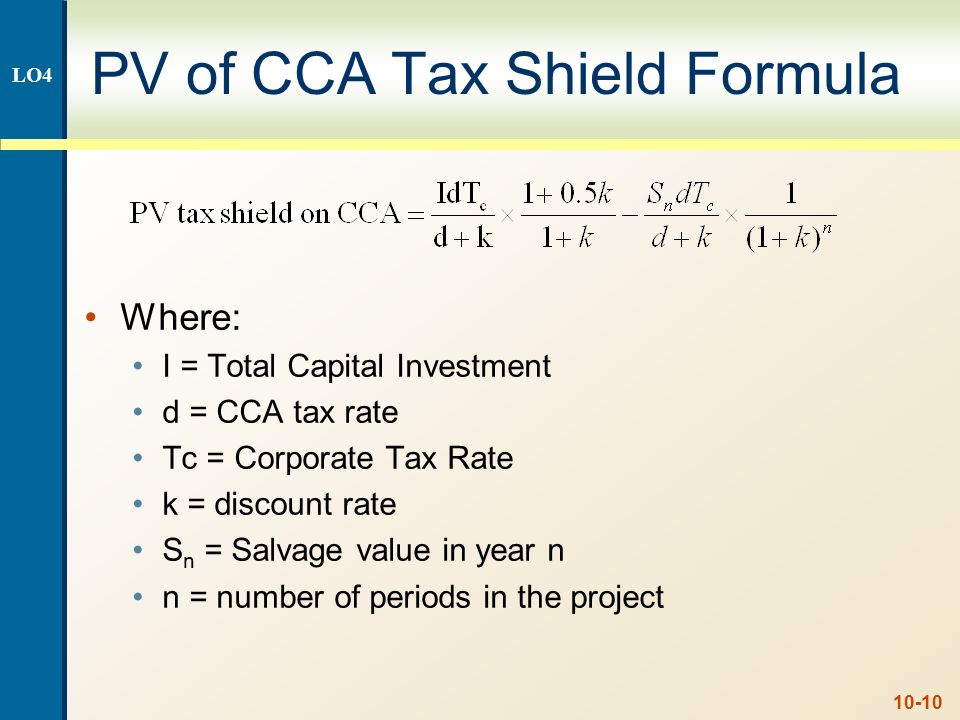

Key Concepts And Skills Ppt Download

Discounted Cash Flow Analysis Street Of Walls

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Discounted Cash Flow Analysis Street Of Walls

Tax Shields Financial Expenses And Losses Carried Forward

Tax Shield Example Template Download Free Excel Template

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

Key Concepts And Skills Ppt Download

Wacc Adjustment To Correct Valuation Of Tax Shields Edward Bodmer Project And Corporate Finance

Training Modular Financial Modeling Ii Dcf Valuations Enterprise Dcf Valuation Dcf Valuation Modano

Unlevered Free Cash Flow Definition Examples Formula

Tax Shield Calculator Efinancemanagement

Review Of Tax Shield Valuation And Its Application To Emerging Markets Finance Intechopen

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis